The risks of buying-renovate-selling in Madrid

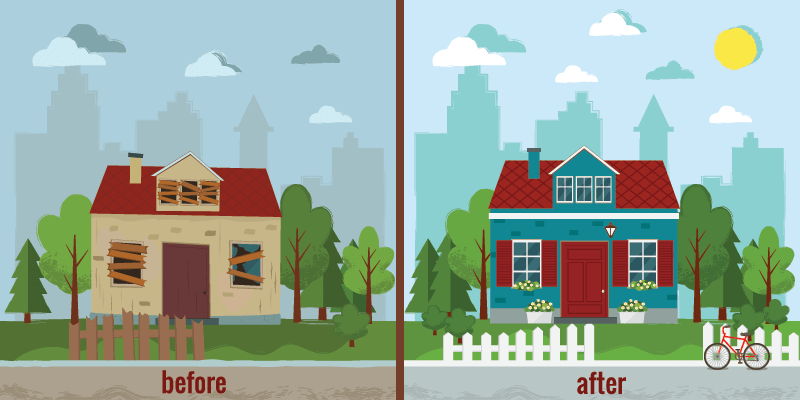

In the case of Madrid, the flipping house fever has reached the capital. Although this term may still be unknown in Spain, in the United States it is one of the most rooted real estate trends of the moment. In essence, real estate flipping is buying a property with the intention of renovating it and selling it in a very short period of time.

Buyers reserve this type of asset at 10% without even having a firm reservation document. There has been a lot of product like that, this makes the price of square meter exorbitant.

All this happens as a result of the lack of supply occur the minimum price denials and very fast closures. “On the other hand, preconceived mortgages have changed the rules of the game all at once, and we have to start fighting again. This is an additional fight to the scarce product that exists”, explains Ángeles Nieto, PSI at Luxury Angels.

The investor profile in Andalucía

If we move to La Costa del Sol, in areas such as Marbella, Benahavís, Estepona or Sotogrande, which is where luxury properties are concentrated, the selling market continues to skyrocket since the demarcation. It should be noted that the trend of buy-reform-sell has also been observed on the Andalusian coast with a large number of clients interested in villas.

Manuel Alarcón, managing director of Libehomes and partner of AEPSI, says that “since Easter the pace of sales has accelerated due to the national premium buyer, as well as the European one”. The British, Belgian, Swedish and French profiles have been responsible for its reactivation.

The behaviour of the Russian client

Since the 2014 Crimean crisis, the Russian customer has stopped mass-buying. That is, it is still active, but only for luxury properties. After the outbreak of the war, we are seeing that more Russian landlords are selling their villas in order to have cash, as the situation of bank blockade makes them very difficult.

The most demanded assets in Galicia

Finally, we go north, the orders in the Rías Baixas are focused on single-family homes between 200,000 and 400,000 euros located in coastal or rural areas. Given that in Vigo, the market is strained because the final approval of the PXOM is pending.